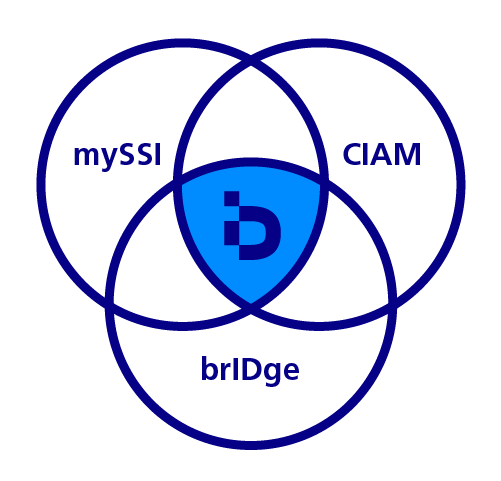

brIDge connects your online services to EU Digital Identity Wallets (EUDIWs) and SWIYU and notified eIDs through one integration – cutting onboarding friction, improving trust, and keeping you compliant with eIDAS 2.0.

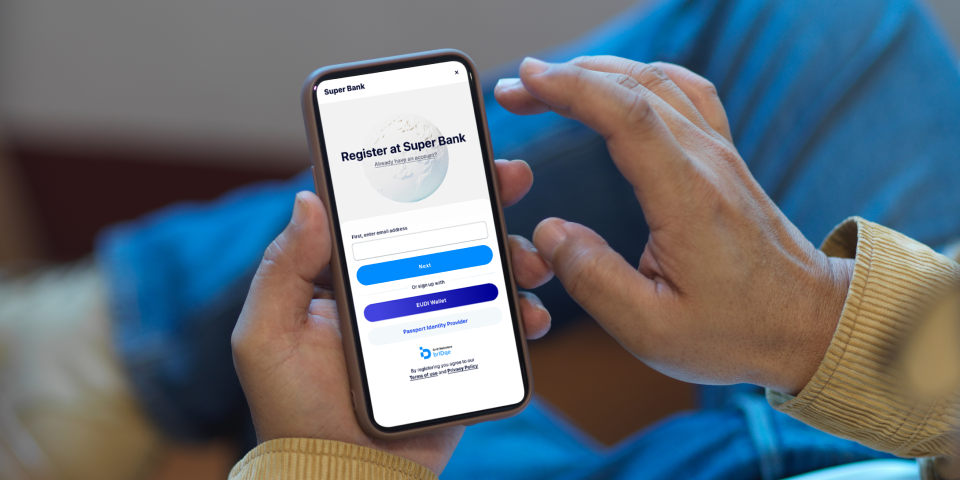

brIDge in Action

- User selects signing up with wallet or eID

- brIDge requests verified claims (name, age, address, IBAN, PID)

- Wallet delivers credentials – brIDge checks cryptographic proofs

- Policy & LoA tags applied to match your KYC/AML rules

- Data is always encrypted while in transit or stored

The result - Faster onboarding, higher conversion, fewer manual reviews, and a clear audit trail