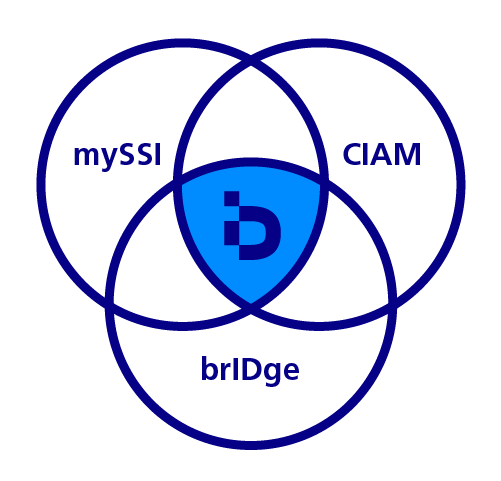

G+D Netcetera’s Digital Identity solutions help you move beyond fragmented logins and outdated verification. We deliver what matters most – higher conversion through frictionless onboarding, stronger security through cryptographic proofs, and future-proof compliance with EU standards.

By combining user-friendly journeys with enterprise-grade assurance, we make it easy to build trusted relationships that scale, without sacrificing agility or customer experience.