Banking fraud evolves quickly, with criminals becoming more creative every day. To address evolving fraud threats, banks need a holistic approach that combines the latest technology with proven security methodologies and the right partner with expertise in fraud. The Verification of Payee (Vop) is a solution that helps to stop payment fraud before it happens, supporting banks, card issuers, and PSPS in meeting upcoming regulations.

What is Verification of Payee (VoP)?

Verification of Payee (VoP) is a banking details security check that confirms the person a customer is paying is actually who they claim to be before the money leaves their account. It is intended to perform verification of the beneficiary’s name and IBAN before approving and processing a payment.

Which fraud tactics are used nowadays, and how does VoP assist?

While scammers once focused on often unconvincing phishing emails, they’re now using more sophisticated social engineering tactics. Today, they’re able to create convincing fake websites that look identical to legitimate financial institutions. They can send personalised messages that reference a customer’s recent activities. And they can even spoof caller IDs to appear as a bank’s customer service number.

These sophisticated tactics are working - Authorised Push Payment (APP) fraud losses in Europe are estimated at €2.4 billion annually, growing at a rate of 20-25% each year.

VoP directly tackles this problem by adding a simple but effective verification step to the payment process.

Verification of Payee regulation

From October 2025, this feature will be mandatory for all Payment Service Providers (PSPs) across Europe under the EU’s Instant Payment Regulation.

How does VoP work?

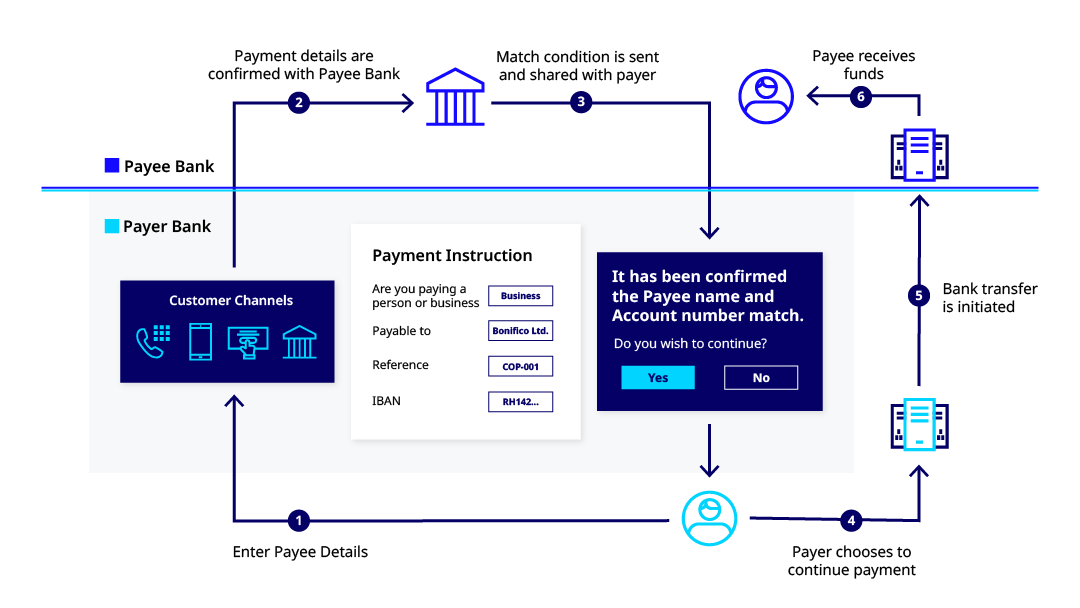

Verification of Payee (VoP) creates a secure verification layer in the payment journey before a payment is processed. It works behind the scenes to provide customers with timely, actionable information at the crucial moment before they commit to sending money.

Overview of the VoP process

- When a customer makes a payment (via mobile, web, or in-branch), they enter the payee’s details, including account number (IBAN) and full name.

- Before processing the payment, the customer’s bank (the requesting PSP) sends a VoP request to the recipient’s bank (the responding PSP).

- The responding PSP checks their records to verify if the account number matches the name provided.

- Within 5 seconds, the responding PSP returns a verification result (match, no match or close match) through a secure API connection.

- The customer is shown the verification result and is able to confirm or cancel the payment.

As shown in the following image, this creates a complete verification loop that protects both the customer and the banks involved.

VoP customer journey

The VoP verification results

When the payment verification is complete, customers receive one of three main responses:

![]()

1. Match:

The payee name matches exactly with the account holder’s name. The customer receives confirmation and can make the payment with confidence.

![]()

2. Close match:

The payee name is similar but not identical to the account holder’s name (e.g. due to nicknames, abbreviations or spelling differences). The customer receives a warning and is shown the actual account name, allowing them to make an informed decision on whether to continue with the payment.

![]()

3. No match:

The payee name doesn’t match the account holder’s name at all, and the customer receives a warning. They can then either cancel the payment or proceed knowing there’s a potential risk.

The technical verification process is conducted between banks using secure, encrypted APIS based on the European Payments Council’s VoP scheme.

The entire process only adds between 1-5 seconds to the payment experience, and it significantly improves how customers are protected from fraud.

How will Verification of Payee benefit banks?

Implementing VoP is a regulatory requirement for financial institutions. However, it also presents a strategic opportunity for early adopters to gain a competitive edge, reduce fraud-related losses, and streamline operational costs.

Benefits include:

- Fraud reduction: Equivalent VoP initiatives launched in the Netherlands and UK have already led to an 81% reduction in all-cause fraud. With APP fraud resulting in losses of €2.4 billion each year in Europe, hundreds of millions of euros could be saved as a result of implementing VoP.

- Fewer payment mistakes: As well as stopping criminals, VoP can catch customer mistakes such as mis-typed account numbers. The Netherlands and UK also saw a 67% drop in misdirected payments after implementing equivalent VoP initiatives.

- Increased customer confidence: VoP gives customers visible reassurance that their money will go to the correct recipient. With 28% of European mobile wallet non-users citing worries about hacked payment details as a top barrier to adoption, VoP could speed up mobile wallet adoption and grow the payments market.

- Getting ahead of regulations: The October 2025 deadline will arrive quickly. Banks, card issuers and PSPs that implement VoP early will be able to use enhanced security as a selling point in the meantime.

How G+D Netcetera’s VoP service can help

Our VoP solution brings together G+D Netcetera’s 25+ years of payment security expertise with cutting-edge cloud technology.

We’ve designed our Verification of Payee solution to be straightforward to implement, allowing you to focus on your core business while we handle the complex security infrastructure.

Key features of G+D Netcetera’s VoP solution:

- Works in real-time: Results appear in seconds, so payments aren’t delayed.

- Easy to implement: Our APIs connect easily with your existing systems.

- Analytics included: Track fraud patterns and see how VoP is helping.

- Works across borders: Supports international payments and multiple currencies.

- Keeps things moving: Adds security without slowing down the payment process.

The October 2025 deadline is quickly approaching. Financial institutions that start implementing VoP now will not only avoid the last-minute compliance rush but will also gain valuable experience in optimising the system for their specific customer base.

Optimize your fraud prevention strategy

Want to learn how our VoP solution works and how G+D Netcetera can help you reduce fraud, meet regulations and protect your customers?

More stories

On this topic