It's more secure than a physical wallet - encryption, tokenization and biometric authentication mean sensitive data is protected even if a device is lost or stolen. It also offers extra features beyond payments, including transaction history tracking, loyalty card storage, automated expense categorisation and instant payment notifications.

Mobile wallet examples include well-known global solutions like Apple Pay and Google Pay, but local alternatives such as Twint (Switzerland) and Wero (Germany) have millions of users too.

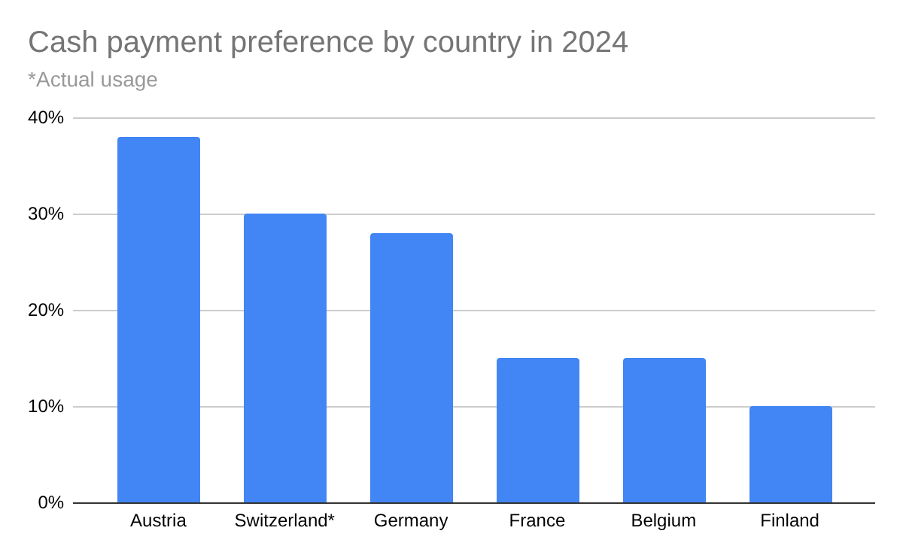

Globally, mobile wallets are used by over 4 billion people (53% of the population). But usage varies a lot within the DACH region. Switzerland leads the group, with an adoption rate of 83% (higher than the 72% EU average). Germany follows at 60%, and just 18% of people in Austria used a mobile wallet in 2024.

Research shows that 32% of Europeans now plan to rely exclusively on mobile wallets. And with projections suggesting that mobile app revenue in DACH will exceed $20.6 billion by 2027, banks that embrace this technology will be well positioned to secure valuable market share as payment preferences evolve.