Conversion describes the rate of successfully completed purchase transactions from those customers who clicked the checkout button. There are various hurdles to overcome for a successful completion: The customer must correctly enter the data for the selected payment method, this data must be processed correctly, the customer must successfully complete the authentication process, and finally, there must be a positive authorization response. At all these points, an abort can occur - with the corresponding negative impact on conversion.

Purchase transactions are aborted, for example, if the customer finds it too cumbersome to enter the card data, if his card has not yet been approved for e-commerce transactions or if the card validity has expired, if the customer's authentication fails, or if the authorization cannot take place due to an incorrect CVV or a limit being exceeded.

Broad data base

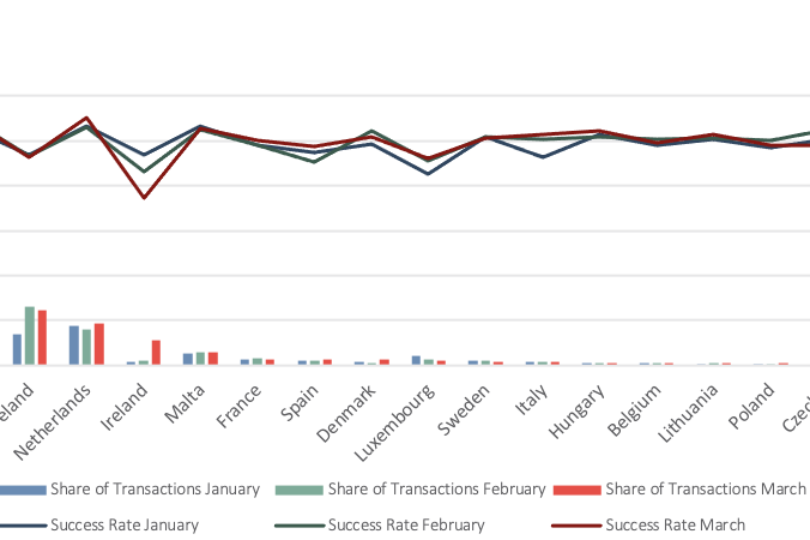

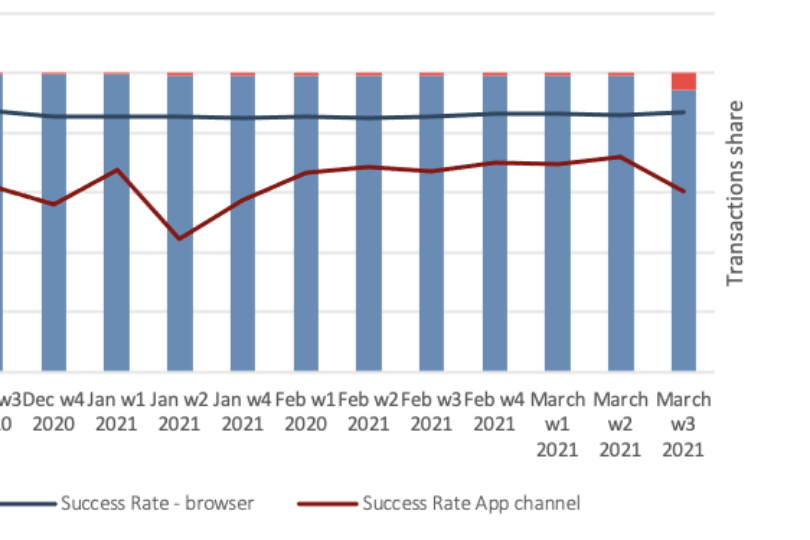

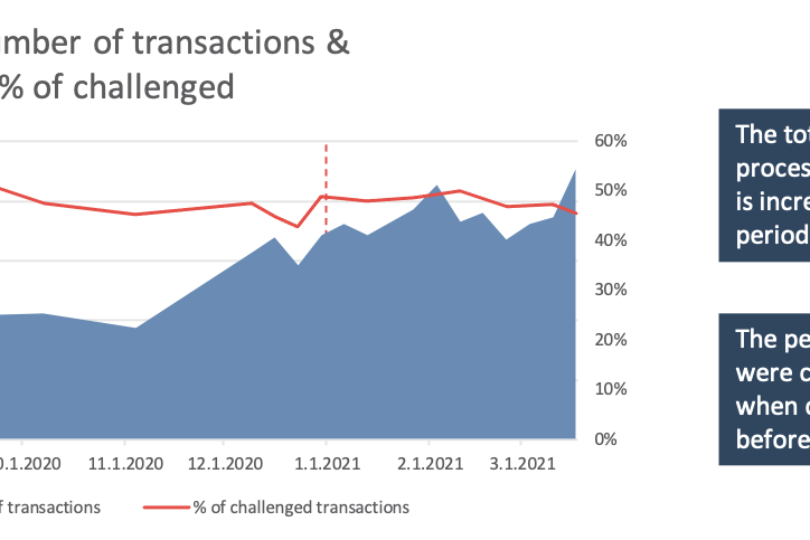

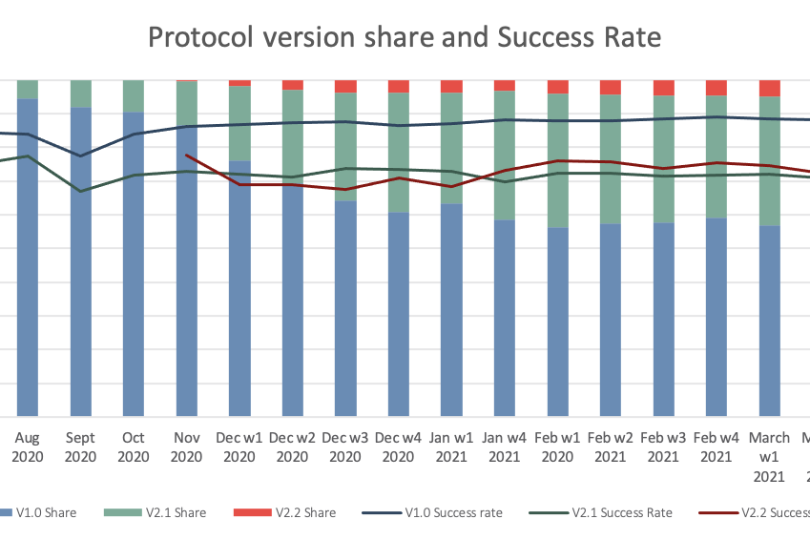

"We can use data from our own Access Control Server (ACS) for such measurements and thus describe the developments from the card issuers' point of view," explains Biljana Kuzeska Ivanoska. From July to December 2020, certain data was considered on a monthly basis, and from January 2021 on a weekly basis. Transactions where one of the parties came from outside Europe were filtered out, as well as test and non-payment transactions. In total, the data set of the sample contained about 2.5 million data records, each with about 50 attributes.

One important result: On average, only 91 percent of the cards are registered for Strong Customer Authentication, whereas for the best issuer only 0.5 percent of the cards were not registered accordingly. At the same time, an average of 2.8 percent of cards are blocked. Unregistered and blocked cards lead to a deterioration in conversion of about 12 percent. This is unsatisfactory for issuers and merchants alike.