Cryptocurrencies

Examples of crypto currencies include Bitcoin or Dash, LiteCoin, Bitcoin Cash and many mored. Crypto-currencies typically run on a decentralized peer-to-peer network, a blockchain, meaning there are no financial intermediaries, middle men, or central banks involved. Because of this, and because they are not backed by fiat money or a commodity, they are also usually volatile and highly speculative. Crypto-Coins cannot be issued or copied twice, are pseudonymous rather than anonymous, and the user usually holds them themselves, so is solely responsible for ensuring they are not lost.

Stablecoins

Stablecoins, such as the USD Coin, Diem from the Facebook Consortium, or Tether differ from cryptocurrencies in that they are pegged to a basket of fiat currencies or to commodities, such as precious or industrial metals. This allows them to be kept stable. That is, 1 coin has a stable value, usually $1.

Stablecoins are often also based on a blockchain - USDC is on the Ethereum blockchain, Tether on the Bitcoin blockchain - but this does not necessarily have to be the case, as the non-decentralized Diem (originally called Libra) initiated by the Facebook consortium shows.

The two aforementioned coin types are directly linked to dollars, which the organizations responsible for the stablecoin promise to store them in safe locations. For Diem/Libra, which are not yet live, a peg to a mixed basket of fiat currencies was originally planned. Today, however, the assumption is a coupling to individual currencies. In other words, there could then be a euro diem or a USD diem, for example.

Central Bank Digital Currency aka CBDC

The CBDC is a completely different beast. Startled by Facebook & co's Diem/Libra initiative, central banks have been pouring more energy into their own central bank digital currencies in recent years. Examples of advanced CBDCs, some of which have already been rolled out, include the Bahamian Sand Dollar, the Cambodian Bakong, the Eastern Caribbean DCash, and China's Digital Yuan. The ECB has adopted a two-year design phase in mid-2021, the U.S. Fed has launched two prototypes, and the Swiss National Bank is currently running a pilot for cross-border payments with France.

However, a broad launch of CBDCs is probably 5+ years in the future.

But why should we have CBDCs at all? On the one hand, central banks are countering the falling use of cash with CBDCs; on the other hand, they are keen to claim and assert their responsibility for the official digital currency in the country.

Since this touches on a broad range of central bank responsibilities, CBDCs, meanwhile, are divided into two subcategories. On the one hand, the "Wholesale CBDC", which accommodates the increased digitization and fragmentation – or tokenization - of assets, i.e. objects, goods, rights. These tokenized assets can be traded most efficiently with tokenized money. So it's about money flows between companies and banks. And on the other hand, the "Retail CBDC", which addresses the replacement of cash and should allow the central bank to support its monetary policy with a digital central bank money. Digital money, in other words, that private citizens are meant to use in the future.

Who benefits from digital currencies?

That, of course, depends heavily on the currency in question. Cryptocurrencies today are mainly investment and speculation objects, like their counterparts gold or precious metals in the real world. Stablecoins, on the other hand, are often used as a transition currency from crypto to fiat currencies. That is, when Mastercard or Visa allow card transactions in Bitcoin today, the amount in Bitcoin is immediately transformed into a stablecoin currency when a purchase is made, and then later converted into the merchant's corresponding fiat currency. This way, the merchant does not experience any exchange losses when the Bitcoin exchange rate fluctuates.

And "wholesale CBDCs," are about transferring money from commercial banks, including cross-border, while retail CBDCs, as mentioned, seek to replace declining cash with a similar digital alternative for citizens.

Should "ordinary" consumers also be interested in digital currencies?

Absolutely! And they already are. For example, to my knowledge, cryptocurrencies have boomed in the pandemic. And in developing countries with inflationary national currencies, they have served asmoney storage and investment vehicles for a bit longer - even for the so-called "under- or unbanked population."

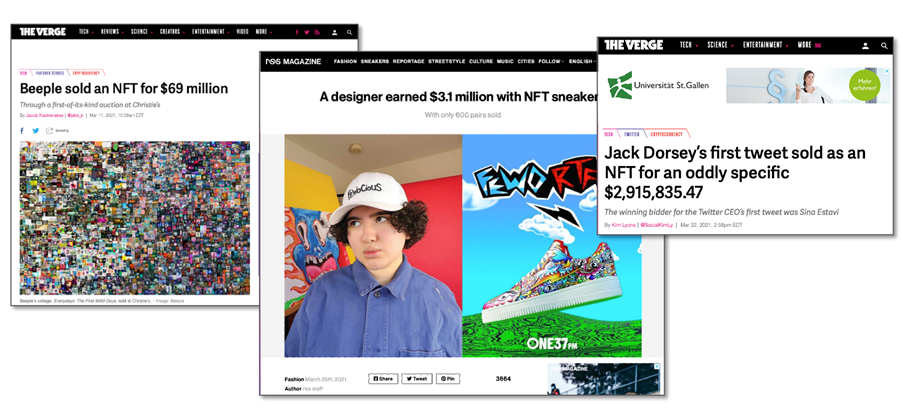

They are also being used, along with stablecoins, in the hyped world of NFTs (non-fungible tokens).

Retail CBDCs will also become interesting for consumers at some point, since they are an alternative to the much-loved cash.