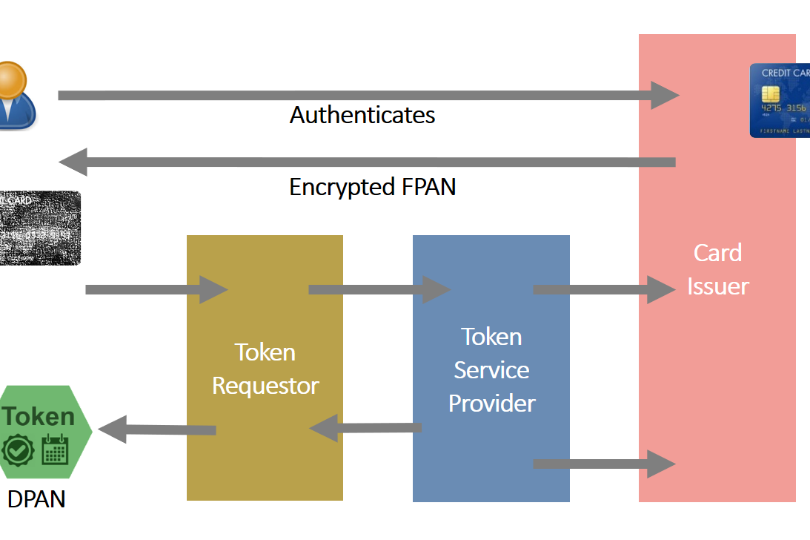

The tokenization allows using payment on all kind of devices and channels. The distribution of a token and the binding to a dedicated use case allow scaling the operations.

Tokenization is common with contactless payments

Issuer Wallets, X Pays, mobile contactless solutions based on smartphones and wearables are today already based on tokenization using TSPs from the schemes (AETS, MDES, VTS etc.).

Tokenization now also for e-commerce payments

PSPs and merchants can benefit from tokenization as well. Card not present payments will increase the security by adding cryptograms in transactions. Also with scheme tokenization there is a connection from the merchant through the PSP via the TSP to the issuer.

This end to end connectivity has two main advantages:

- The customer sees his real card picture and card details (like in X Pays)

- Once the issuers updates or renews the card the assigned token holder (e.g. the merchant) will be notified. Today accepting recurring payments is a challenge as around 3% of the stored cards are ending their lifetime each month.

How to approach this as PSP or merchant

Typically merchants want to support all relevant schemes. This entails developing an interface to all major TSPs like AETS, MDES, VTS etc. Such a project with each scheme is costly and time consuming. Netcetera has done this integration work with the ToPay Cloud Payment solution already. Now we are extending this service to offer a unified and easy way of using scheme tokenization in e-commerce applications.

Netcetera offers standardized interfaces (API) to PSP and merchants to reduce complexity and accompanies the entire process of onboarding (MDES, VTS, AETS) with the schemes. We support the following main use cases:

|

Enrollment |

Card data can be added manually or tokenized from card on file. |

|

Display card art and card information |

The card date (e.g. last 4 digits of funding PAN, card product name, card image) can be retrieved and shown to the consumer |

|

Transacting |

A cryptogram can be generated for a transaction |

|

Lifecycle Management |

Notification to keep card data up to date – once an issuer blocks or renews a card the merchant will be notified |

The benefits for merchants and PSPs

Summarizing the advantages of scheme tokenization in e-Commerce payments we can confirm this is a big step forward:

- Merchants get significantly higher approval rates

- PSPs get higher security and less risk

- Card holder sees where the card is enrolled, their real card data and images

- Merchants have direct connection to the card issuers and do not need to bother with expired cards

Netcetera combines this technology with our 3DS SDK and the 3DS Server, to fulfill the requirements of PSD2 in combination with merchant tokenization.