Having said that, tokenization protects what would otherwise be more easily exposed to fraudsters. So, it reduces the risk of fraud, and the cardholder can feel safe that the data cannot be compromised. Only by securing the most important element of this process, tokenization supports the different angles of the online payment process: providing the needed security, decreasing cart abandonments, and helping merchants to get rid of lost sales opportunities.

It is a technology that benefits the different types of payment players during online payments, by lowering abandonment rates, supporting higher transaction value, and higher conversion rates; it increases revenue and enhances risk mitigation.

How to avoid costly and time-consuming integration and certification processes?

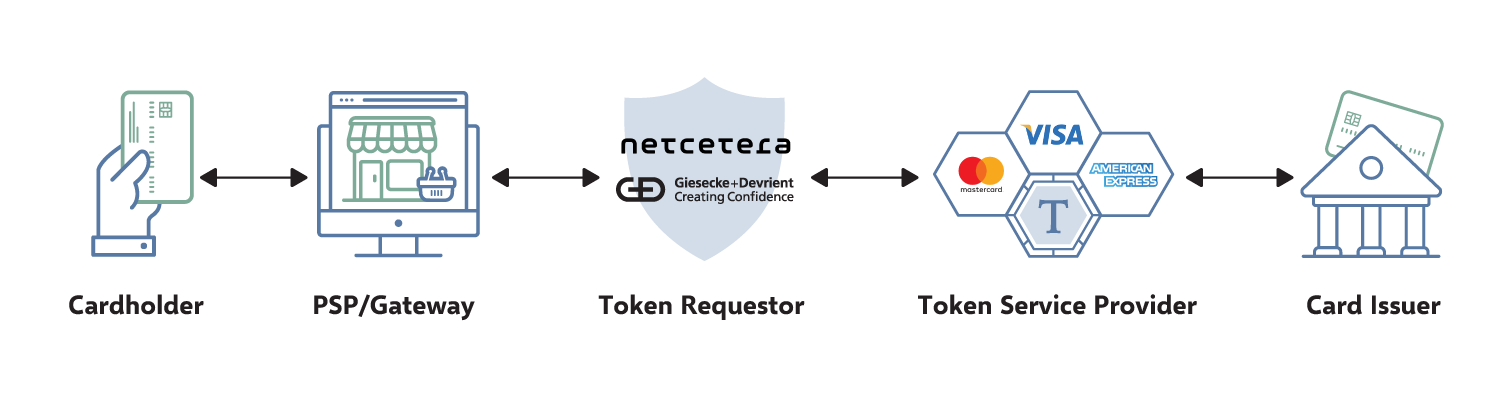

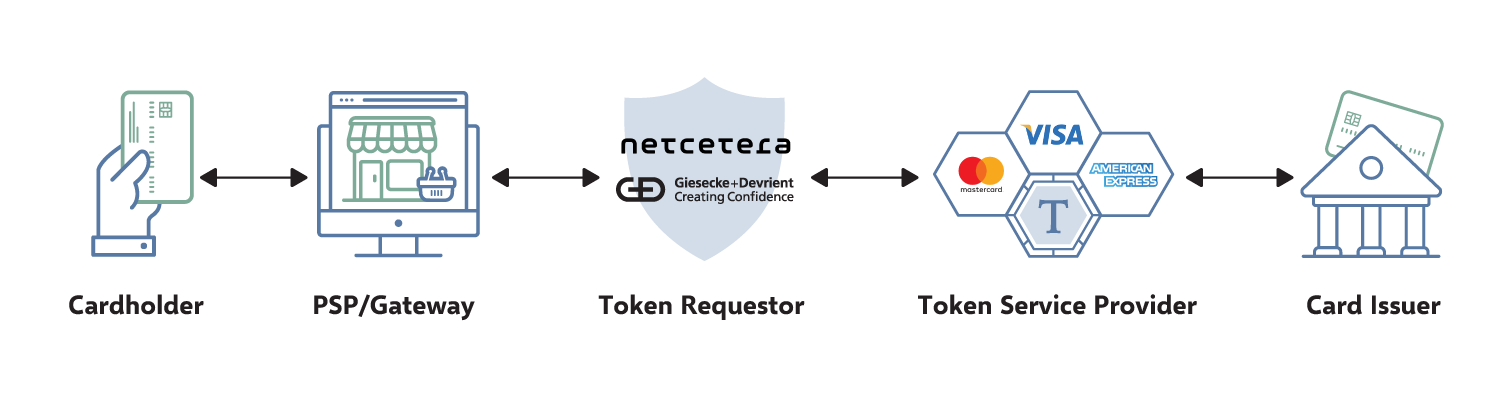

The best solution is to go through one interface that connects to multiple card networks. The eCOM Tokenizer (Netcetera tokenization solution) – is exactly that one interface that can connect to multiple card networks.

It enables merchants or PSPs to connect to all major card networks’ token service providers via a single API, without having to go through costly and time-consuming integration and certification processes with each card network separately.

Card networks prove that, in practice, network tokenization has clearly shown that the rates of approved transactions increase by up to six percent compared to conventional processing.

During the card enrollment, the eCOM Tokenizer obtains a network token from the Token Service Provider (TSP).

Through the checkout, each transaction is strengthened with an additional element, the cryptogram, which contributes to higher security.

The lifecycle management tool ensures seamless and secure eCommerce, where the network token is decoupled from the funding card for notification renewals, and the card data updates happen without any involvement of the cardholder.

As an additional step towards ensuring a seamless customer experience is combining the eCOM Tokenizer with simplified payment solutions like:

The joint solution from G+D and Netcetera, which is available worldwide, will help merchants and PSPs to enhance their conversion in e-commerce transactions.