EMV 3DS 2.3.1 certification of all components

Designed for payment networks to support their partner´s end-to-end e-commerce testing and on-boarding.

EMV 3DS 2.3.1 certification of all components

Netcetera’s 3-D Secure Quality Assurance Platform was created based on many years of experience and expertise in the testing and certification of 3-D Secure products. It covers the entire spectrum of the payment industry and boosts trust in online payments based on data, accuracy and security. The platform is a flexible and highly configurable product with possibilities to be created according to the various business needs and specific card network rules.

Below, we will explore the significance of the Netcetera 3-D Secure Quality Assurance Platform for card networks, its key features, and the benefits it brings to the entire financial ecosystem.

Challenges, Key features and Benefits for the financial ecosystem.

The digital world has brought many challenges to the payment stakeholders. With the ever-changing consumer behaviour, increasing competition, and the need to innovate and adapt to emerging technologies, the card networks, the issuers, and merchants are in a constant daily run to enable an outstanding customer experience, which is seen as a pre-condition for successful business growth.

In the fast-paced world of digital transactions, consumers demand fast and easy yet secure services, and card networks play a crucial role in ensuring seamless, secure, and reliable payment processing. Card networks heavily rely on comprehensive testing, monitoring, and validation services to maintain the highest standards of performance, accuracy, and security.

Different factors could be causing lower performance than expected. Still, the crucial factors determining the success of the e-payment system are reliability, cost, infrastructure, technology, customer information security and convenience of the payment method.

However, the production analysis does not allow a straightforward detection of the root cause. That is when a quality assurance platform steps in.

Netcetera 3-D Secure platform is created to enable the network operators to detect failures, mitigate risks and minimize financial losses by ensuring that the transaction is successful. The process follows the latest payment protocols, even for those still not live or implemented, so that the card networks can be prepared well before time.

"The Platform is an ideal solution for payment networks that want to enter the market earlier with new 3-D Secure versions, functions, and features, offering its customers a better user experience when shopping online."

- Roger Burkhardt, Secure Digital Payments Netcetera

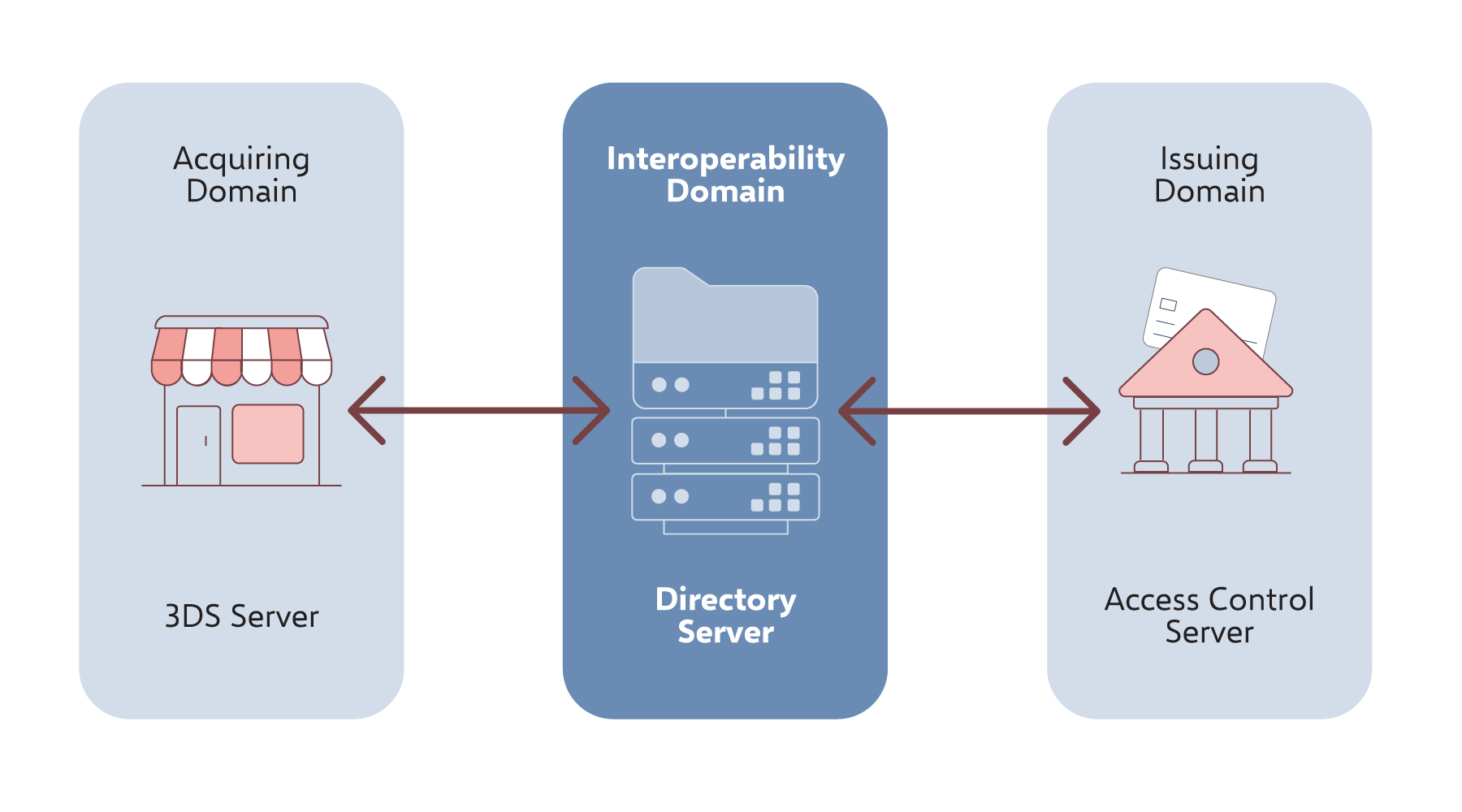

With the card networks’ mandates for EMV® 3DS, many merchants and payment service providers are going live with new 3-D Secure solutions. The quality of their 3-D Secure implementation is especially crucial for the merchants striving to optimize the user experience for the consumer. Merchants, PSPs and acquirers using the Netcetera Quality Assurance Platform can onboard a card network’s latest EMV® 3-D Secure 2. x Directory Server regardless of Access Control Server (ACS) provider readiness. Card issuers using the Netcetera Quality Assurance Platform can start testing their integration on a card network’s latest EMV 3-D Secure 2.x Directory Server independently from merchants’, acquirers’ and PSPs’ readiness.

Comprehensive Testing and Validation

The 3-D Secure Quality Assurance Platform of the payment expert, Netcetera, offers robust testing and validation capabilities, allowing card networks to ensure the smooth functioning of their payment systems. It simulates real-time scenarios, validating the interoperability of card networks. Through extensive testing, it identifies and resolves any performance bottlenecks, ensuring a seamless experience for consumers and merchants. Additionally, the Quality Assurance Platform assists in testing new features, updates, and integrations, reducing the risks of non-authenticated transactions, bugs or compatibility issues into the network.

"Some things are not negotiable. In e-payments, such as security and seamless customer experience. In that regard bringing the best services on board can only benefit the different businesses. Netcetera’s Quality Assurance Platform can satisfy the needs even of those obsessed with the quality, no matter which part of the payment process is concerned."

Ensuring Compliance and Regulatory Standards

Netcetera Quality Assurance Platform acts as a safeguard for card networks, ensuring compliance with various regulatory requirements. It assists in maintaining adherence to industry standards such as the Payment Card Industry Data Security Standard (PCI DSS), ensuring that sensitive cardholder information is protected, and transactions are securely processed. The 3-D Secure platform of the international payment provider continuously monitors and audits the infrastructure processes, identifying vulnerabilities and potential risks. By doing so, it enables card networks to proactively address compliance issues, minimising the likelihood of data breaches or non-compliance penalties.

"The 3-D Secure Platform covers the entire payment spectrum, offering a full 3DS Test Suite (3-D Secure Access Control Server, 3-D Secure Directory Server, 3-D Secure Server/SDK). Netcetera’s platform helps not only card networks but the card issuers, merchants and PSPs, ensuring the quality of 3-D Secure and enabling a fast and smooth onboarding."

Performance Optimization and Scalability

As card networks handle millions of transactions daily, performance optimization and scalability are paramount. The platform offers valuable insights into the performance, identifying potential gaps or inefficiencies. Analyzing transaction processing times, response rates, and resource utilization, it helps optimize network performance, ensuring smooth and rapid transaction processing. Furthermore, it assists in capacity planning and scalability, enabling card networks to handle increased transaction volumes without compromising performance or security.

Continuous Improvement and Innovation

Continuous improvement is part of Netcetera’s mission. In that regard, all the products and services of the Company aim to improve its clients’ conversion rates or stay compliant with the PSD2 requirements. The 3-D Secure Platform plays a significant role in driving continuous improvement and innovation within card networks. It provides valuable data and analytics and makes it easy to identify the areas for improvement, optimize processes, and enhance customer experiences. By monitoring user feedback, transaction patterns, and system performance, it helps to identify emerging trends and customer needs, facilitating the development of new features and services.

In the ever-evolving landscape of digital payments, Netcetera’s 3-D Secure Quality Assurance Platform is of indispensable importance for card networks. By ensuring compliance, providing comprehensive testing and validation, enabling real-time monitoring, optimizing performance, and driving innovation, it enhances the efficiency, security, and reliability of payment processing systems. Considering the constant growth of the transaction volume, the Platform can be critical for card networks in maintaining the trust and confidence of consumers and merchants in card networks.

Netcetera Quality Assurance Platform leverages the latest authentication standards of EMV® 3-D Secure to complete more transactions successfully and without disruption.

On this topic