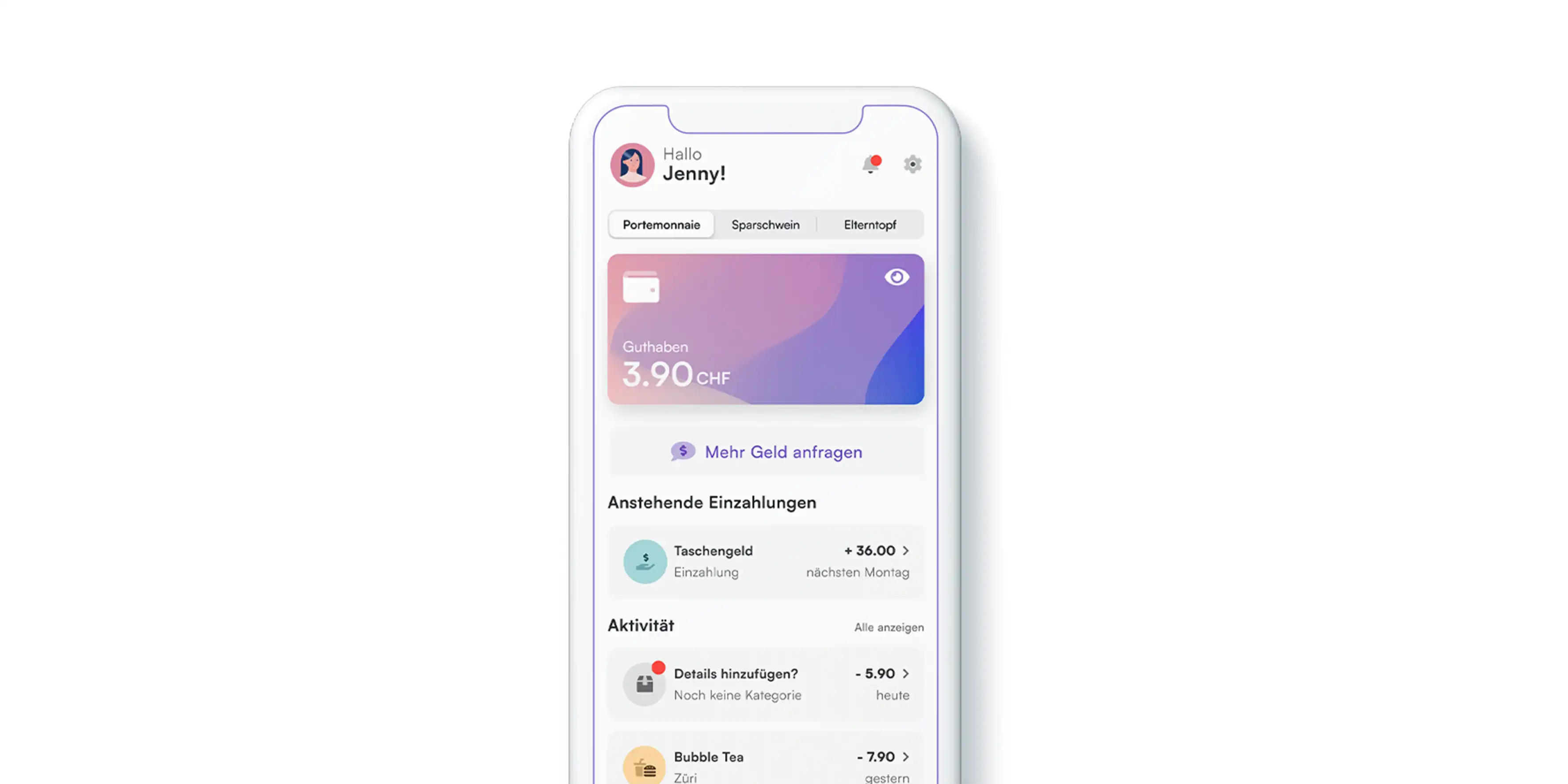

Cockpit for teenagers

Financial literacy

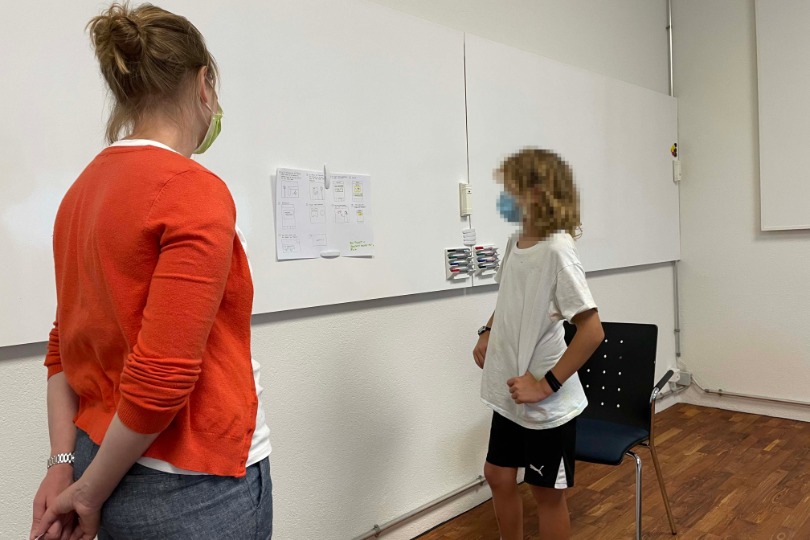

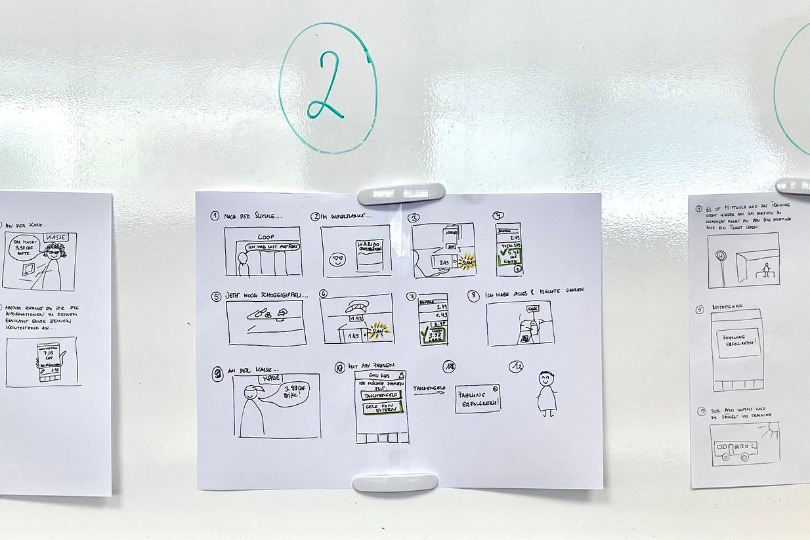

Safe space and contextual support in acquiring financial skills

Privacy for teens

Same experience as paying with cash, but with a debit card

On this topic