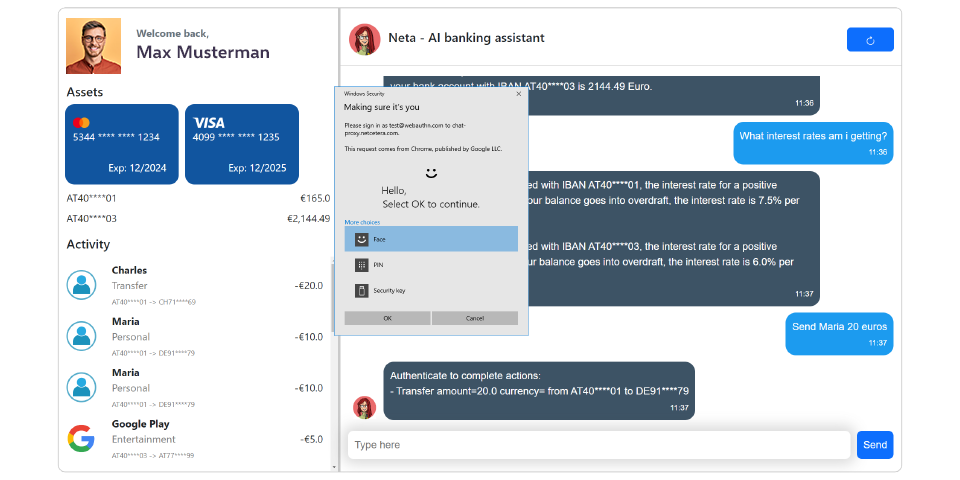

The incorporation of chatbots has transformed conversational banking, serving as a crucial catalyst in the financial industry's advancement. This transformation is driven by the quest for an improved customer experience, increased operational efficiency, substantial digitalization efforts, and a commitment to enhancing financial literacy.

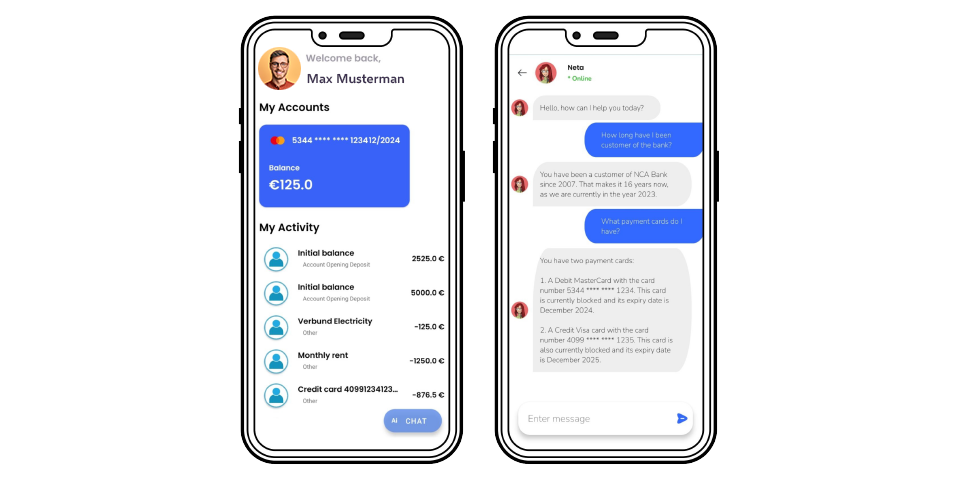

An AI banking assistant empowers you with personalized, conversational, and efficient mobile and web banking services at your fingertips.